The Influence of Politics on Financial Markets

With the upcoming elections stirring conversations and uncertainties, many are pondering the implications for their finances and investments. It’s natural to wonder: do politics truly impact the stock market?

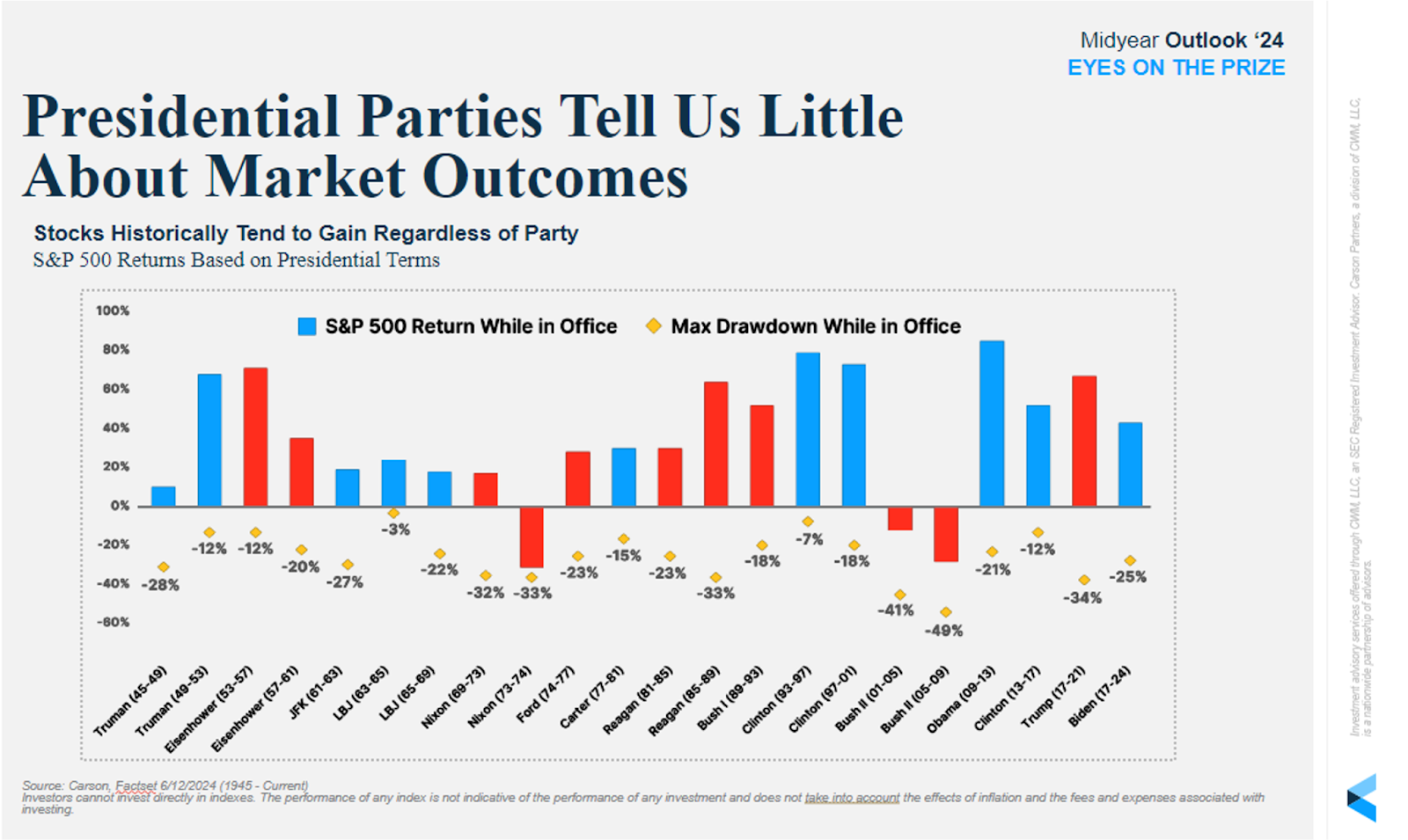

At Strategic Retirement Plans, we’ve witnessed the enduring truth that markets have historically continued to flourish, irrespective of the political party in power, as shown in the graph below. It’s understandable that uncertainties may lead individuals to consider pulling their investments from the market out of fear, but we believe that reacting solely based on such apprehension can lead to missed opportunities. Our prudent approach emphasizes staying the course and handcrafting resilient, long-term financial strategies that weather the ebb and flow of political landscapes. By remaining committed to well-thought-out investment plans, you can uphold the confidence that has sustained the growth of many portfolios through various political climates.

Essentially, based on what we know, we think markets see “green” a lot more than they see “red or blue.” That being said, politics can and do impact the stock market, but those impacts are mostly based on policy rather than party.

Looking Beyond Partisan Divides: Focus on Policy

Reflecting on the past 50 to 60 years, we find that regardless of party lines, it’s the policies enacted that hold the most weight in shaping financial outcomes. While the presidency garners attention, it’s crucial to recognize that the House and Senate play pivotal roles in determining the policies that impact your portfolio.

As we approach the upcoming election, we prioritize examining key policy dynamics that could influence market trends. The impending decisions on corporate tax rates, tariffs, and national debt carry significant weight in shaping economic landscapes. Our attention to these policy shifts allows us to strategize effectively and position portfolios for stability amidst fluctuating markets.

Preparing for Financial Uncertainties with Strategic Planning

Amidst discussions on gas prices, tax rates, inflation, and interest rates, it’s essential to concentrate on crafting a robust financial plan tailored to weather the inevitable highs and lows. As we celebrate Financial Planning Month this October, it serves as a gentle nudge to ensure you have a well-thought-out strategy that can guide you through the highs and lows of economic landscapes. One way to determine the resiliency of your portfolio is to have it stress-tested – in other words, examine its capacity to withstand various market conditions – which is a service our financial advisors provide.

Embracing the Future with Confidence

As we move forward into the election season, our commitment to your financial well-being remains steadfast. We view these turbulent times as opportunities to strengthen your portfolio, ensuring that it remains steadfast and prepared for whatever the market may bring. If you have questions or seek reassurance amidst the changing financial landscape, we invite you to connect with us at Strategic Retirement Plans. Together, we will navigate the complexities of elections and finances, empowering you to stride confidently towards your retirement goals.