Presented by SRP

Quick Hits

- Markets Rebound in May

Stocks rallied after declining in April. - Falling Yields Support Bond Prices

Falling interest rates caused bond price to rise. - Labor Market Cools in April

The April jobs report showed encouraging signs of softening labor demand. - Additional Signs of Slowing Growth

Several key economic updates pointed toward slowing growth. - Market Risks to Monitor

Domestic, international, and unknown risks remain for markets. - Improving Fundamentals and Positive Outlook

Economic and market fundamentals support future improvements.

Markets Rebound in May

Markets rallied in May, with all three major U.S. indices up for the month. The S&P 500 gained 4.96 percent, the Dow Jones Industrial Average grew 2.58 percent, and the Nasdaq Composite soared 6.98 percent. Equity markets were supported by solid earnings growth and lower interest rates.

Per Bloomberg Intelligence, as of May 30, with 98 percent of companies having reported earnings, the average earnings growth rate for the S&P 500 in the first quarter was 7.8 percent. This is notably higher than analyst estimates at the start of earnings season for a 3.8 percent increase. Growth was widespread, with 10 of 11 sectors beating analyst estimates. Earnings have increased in each of the past three quarters, which is an encouraging sign for investors because fundamentals drive

long-term performance.

Technical factors were also supportive. All three major U.S. indices spent the entire month above their respective 200-day moving averages. (The 200-day moving average is a widely monitored technical indicator because sustained breaks above or below this level can signal shifting investor sentiment for an index.) The combination of continued technical support and improving fundamentals in May was welcome after short-lived declines in April.

The story was similar for international equities. The MSCI EAFE Index gained 3.87 percent and the MSCI Emerging Markets Index rose 0.59 percent. Technical results were also supportive for international stocks; both the MSCI EAFE and MSCI Emerging Markets indices spent the entire month above their respective 200-day moving averages.

Falling Yields Support Bond Prices

Falling long-term interest rates helped support bond prices. The 10-year Treasury yield fell from 4.69 percent at the end of April to 4.51 percent at the end of May. Signs of slowing economic growth and a cooling job market contributed to the fall in interest rates. The Bloomberg Aggregate Bond Index gained 1.7 percent.

High-yield bond returns were also positive, supported by stable credit spreads that ended the month largely unchanged. The Bloomberg U.S. Corporate High Yield Index gained 1.1 percent.

Labor Market Cools in Apil

The May rally for markets was sparked by signs of slower economic growth, which helped calm investor concerns about a potentially overheated economy. The April job report was a highlight; it showed a notable slowdown in hiring, with 175,000 jobs added during the month. This was down from the 315,000 jobs added in March, and it was viewed by investors and economists as a healthy development after months of stronger-than-expected job growth to start the year.

Underlying employment data also pointed toward slower growth, with annual wage growth falling to a two-year low and the unemployment rate picking up modestly. Softening labor market conditions are one factor the Federal Reserve (Fed) has noted could lead to interest rate cuts later this year because of the central bank’s dual mandate to support stable prices and maximum employment.

The Takeaway

- Slowing job growth in April was a welcome development for investors concerned about inflation.

- Underlying data also showed encouraging signs of softening labor demand.

Additional Signs of Slowing Growth

Other economic releases also pointed toward slower but potentially healthier growth for the economy. Personal income and spending growth came in below expectations in April, which is another good sign for investors concerned with inflation. Speaking of inflation, the April Consumer Price Index report was also supportive; it showed that consumer prices rose less than expected in the month and consumer inflation slowed on a year-over-year basis.

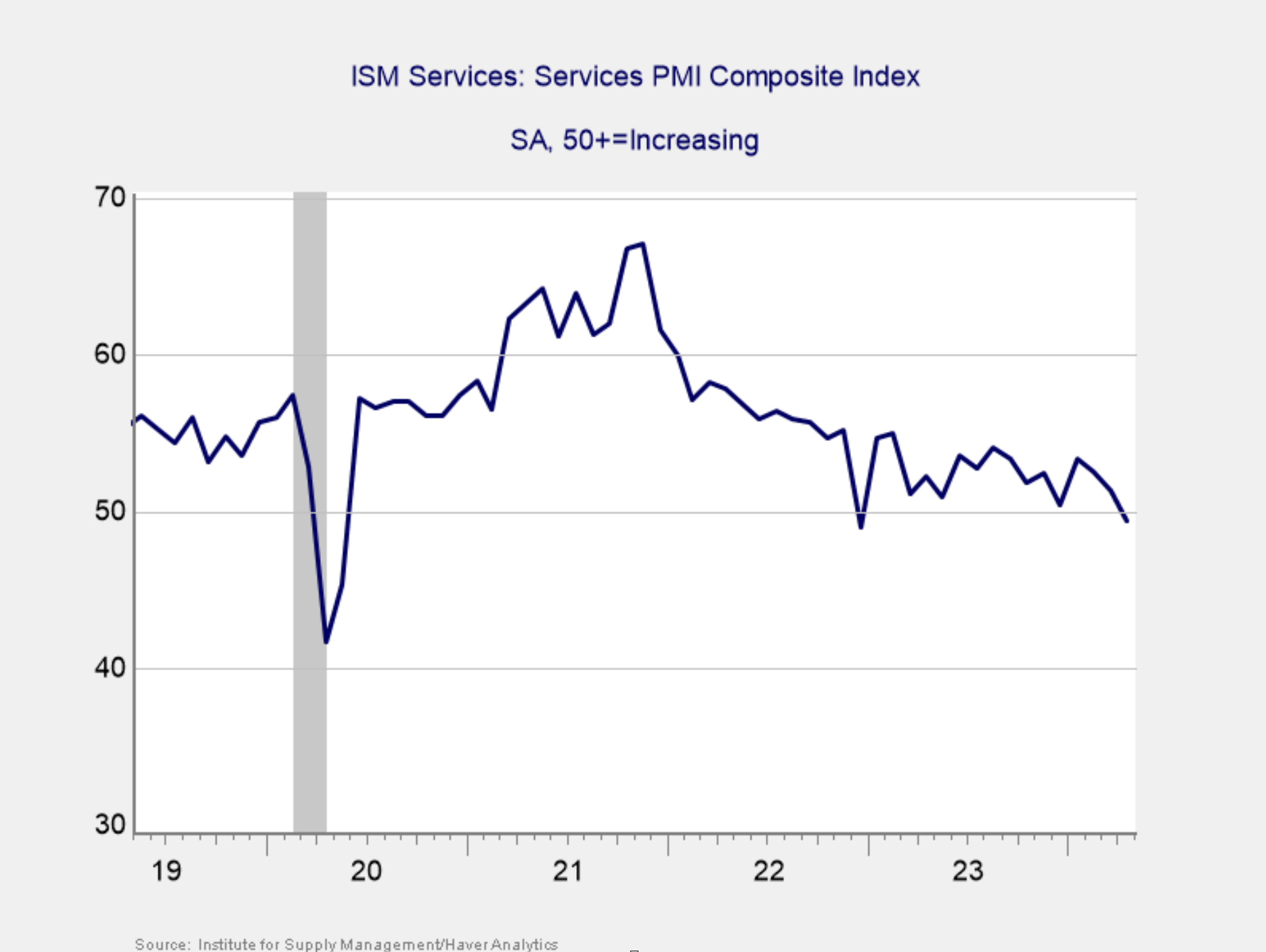

Consumer and business confidence also declined in April. As you can see in Figure 1, service sector confidence fell for the third consecutive month, bringing confidence to its lowest level in more than one year. This is a diffusion index, where values above 50 indicate expansion and values below 50 indicate contraction. April marked only the second time service sector confidence has dropped into contractionary territory since the end of pandemic-era lockdowns. The service sector accounts for the majority of hiring in the U.S.; falling service sector confidence signals potentially lower demand ahead for service

sector workers.

Figure 1: ISM Services PMI Composite Index

Source: Institute for Supply Management/Haver Analytics, 05/03/2024

The Takeaway

- Slowing economic growth and falling inflationary pressure were welcome developments.

- Falling consumer and business confidence could be a sign of further slowdowns ahead.

Market Risks to Monitor

Although the signs of slowing growth were largely welcomed by investors and economists, inflation remains one of the most pressing risks for markets. As we saw in April, interest rates and stocks remain sensitive to signs of rising inflationary pressure, and it’s possible we’ll see an uptick in inflation in the months ahead that could dissuade investors.

In addition, we face considerable political uncertainty because of the U.S. federal elections in November. We’re likely to see this uncertainty ramp up as we kick off the political convention season this summer and head toward Election Day in the fall.

International risks remain, too, as shown by continued conflicts in Ukraine and the Middle East. Although the direct market impact of these geopolitical events has been largely muted, they still serve as sources of global uncertainty that have the potential to negatively impact markets. In addition, the continued slowdown in China is worth monitoring because of the nation’s importance to the global economy.

And, of course, there are always unknown risks that could materialize and affect markets.

The Takeaway

- Real risks remain for markets, both domestically and abroad.

- Domestic risks include inflation and political uncertainty, whereas ongoing conflicts in Ukraine and the Middle East highlight the international risks.

Improving Fundamentals and a Positive Outlook

Despite the risks markets face, we are in a good place on the whole. The signs of slowing but still positive growth for the economy were a welcome development and signal a potentially healthier economic backdrop in the second half of the year. In addition, strong earnings growth in the first quarter was a positive sign for investors. Looking ahead, analysts expect to see continued strong earnings growth throughout the year, which should be a tailwind for markets. With a supportive economic backdrop and improving fundamentals, markets appear set for a strong second half of the year.

That’s not to say we can’t or won’t face setbacks along the way. April was a reminder that, though we’ve made progress in tamping inflation down, there remains real work to get back to the Fed’s 2 percent target. Although the most likely path forward is for continued economic growth and market appreciation, it’s quite possible we’ll see short-term speed bumps along the way. Given the potential for uncertainty, a well-diversified portfolio that matches investor goals and timelines remains the best strategy for most investors. If concerns remain, however, speak to your financial advisor to review your financial plans.

Disclosures: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

###

Authored by Brad McMillan, CFA® managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®.

© 2024 Commonwealth Financial Network