What a difference a couple of years makes. At the end of 2021, interest rates were at rock bottom, and banks offered savers little more than crumbs. Fast forward to today, and the Federal Reserve has lifted interest rates north of 5%. Interest rates on savings accounts, CDs, and money markets have been trending upwards with a lag. Today, interest rates above 4% can be found on high-yield savings, certain CDs, many money market funds, and high-quality bonds alike.

With that in mind, it’s not surprising if you’re asking yourself two questions. First, should we be excited to own more fixed-income investments? Second, why would we want to own volatile bonds rather than extremely stable money market funds or CDs? With this letter, we’re hoping to answer these questions.

Do we like fixed income today?

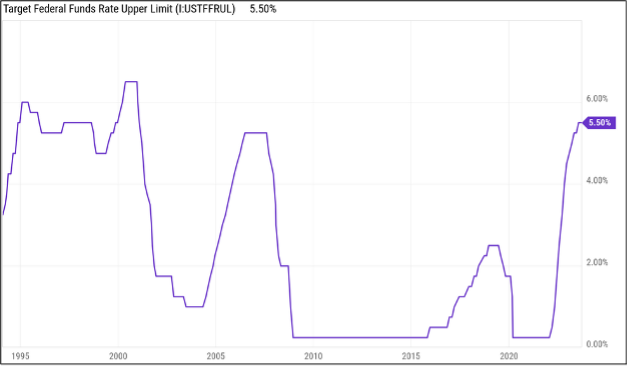

Yes! There is a strong case that interest rates today represent a near-historic opportunity. While it’s a matter of debate what the long-term level of interest rates in the US should be, it’s widely agreed that a ‘normal’ rate is much lower than the 5-5.25% the Fed is holding today. These interest rates won’t stick around forever. This means that fixed income (of all types) offers a higher rate of return for less risk than is normally the case. Today, we can obtain rates of income in the mid-single digits on the lowest-risk forms of fixed income, and most bonds are trading at prices below their face value, which means that in addition to receiving coupon (interest) payments, we can expect to have them increase in price as they near maturity.

The Path of Short-term Interest Rates as set by the Federal Reserve

Data Source: Morningstar

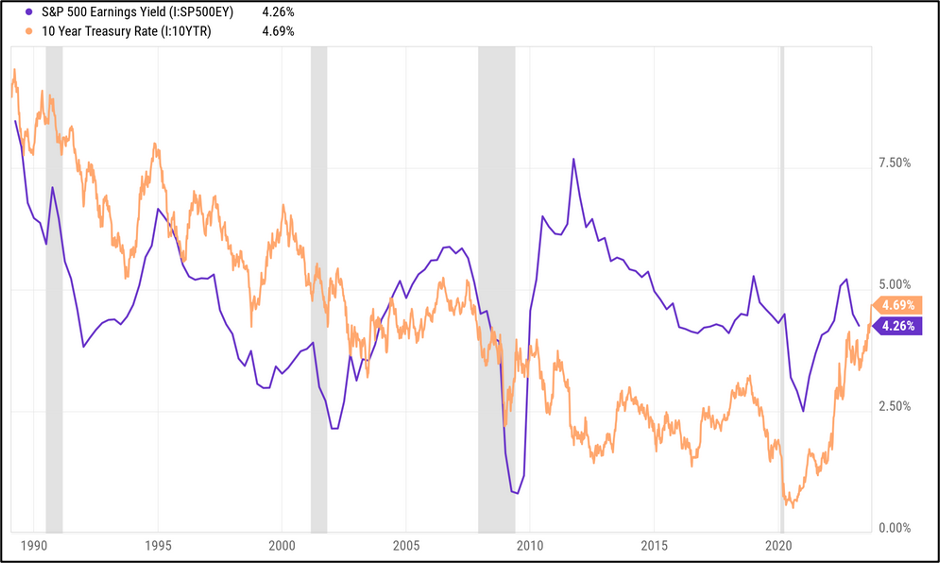

There’s also a good case that fixed income is currently attractive relative to stocks. One way to look at it is to compare the yield on fixed income with the ‘earnings yield’ on the stock market. Earnings yield is simply company earnings divided by share price. Normally, stocks offer a much higher yield than bonds to compensate investors for the higher risk associated with stocks. But not today.

Earnings Yield of the S&P 500 vs Yield on the 10-year US Treasury

Data Source: Morningstar

While comparing earnings yield to yield on fixed income is not exactly an apples-to-apples comparison, it does indicate that one of these asset classes is mispriced. And that is even more the case now than the last time we communicated on this topic. Either fixed income is cheap, stocks are expensive, or both. In order for stocks to outperform fixed income in a sustained fashion over the next few years, we would need to see significant earnings growth and/or higher prices without much earnings growth. That’s far from guaranteed.

Why hold bonds instead of less volatile forms of fixed income?

If we can get very similar yields on a CD, a money market fund, or high-quality bond, why shouldn’t we just own the CD or Money Market fund? After all, you don’t have to deal with price volatility on a CD or money market fund, and it’s possible that bonds could fall slightly further in price if supply of new treasuries outstrips demand. CDs and money market funds would outperform bonds in that scenario, at least in the short term.

First, most CDs are illiquid and have a kind of ‘cost’ in that they limit your ability to reposition and take advantage of opportunities in the markets as they arise. We can use money market funds more efficiently than CDs within our investment process because they don’t sacrifice flexibility.

Second, there is an often-overlooked advantage to holding longer-term fixed income like bonds. While a money market fund can offer similar or even higher levels of interest than some types of bonds today, this will probably not last. When interest rates eventually drop, returns on money market fund returns fall right in sync, leaving investors to reinvest their interest income at subsequently lower rates. That’s a problem you can avoid with bonds. As long as the issuer of the bond doesn’t default, your interest rate (yield) is locked in at the point of purchase as long as you hold it until maturity. This means that bonds will outperform money market investments over time if interest rates fall. And fall they must. It’s only a question of when.

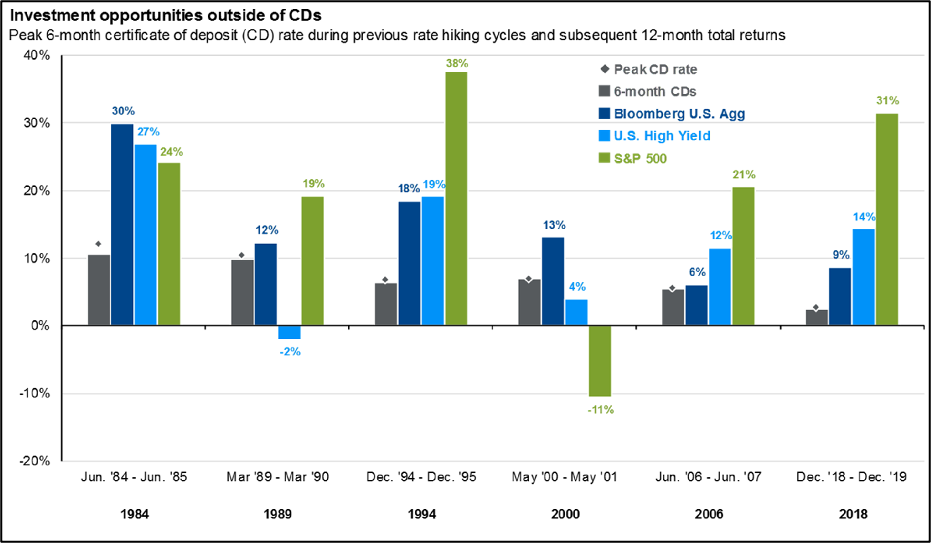

This concept is illustrated in the chart below from JPMorgan. In the past episodes of high CD rates, bonds (represented by the Bloomberg US Aggregate Index) outperformed CDs after the peak in rates – every single time. Moreover, they outperformed stocks in two out of the five episodes.

Source: JPMorgan Guide to the Markets

Lastly, bonds with some interest rate exposure offer better protection to your portfolio than cash or money market funds in a typical recession scenario. In an average recession, we wouldn’t expect money market funds to lose value. However, bonds are likely to actually gain in value in such a scenario. This means that while bonds are ‘riskier’ than money market funds on a stand-alone basis, a bond/equity portfolio is usually less risky than a bond/money market fund portfolio in most market downturns. Both in the dot-com bust and during the financial crisis of 2008, bond/equity portfolios outperformed an equivalent mix of money market funds and equity.

We often explain that we don’t have a crystal ball. It’s been a tough year for bonds, and it’s possible that could continue for a bit. For that reason, up until now, we’ve kept the maturities on your bond portfolio shorter than the market as a whole to limit that downside. But with an eye on the medium to long term and balancing the probabilities here, we believe bonds should still make up most of the fixed income allocation in your portfolio rather than money market funds. Moving heavily into money market funds would certainly work well over a one-year horizon but at a cost. That’s because, without perfect timing, it could result in failing to capitalize on the opportunity to lock in these rates over a longer timeframe.

We hope this letter provides some useful color on our decision-making process and increases comfort level around bond holdings in the portfolio. As always, we’re here for you and available for discussions and to answer any questions you may have.