There are several common false assumptions and misconceptions about investing that we work to educate our clients on. We thought we’d share these “myths” with you and help you “bust” the myth and move toward informed financial decision making.

Myth #1: You have to time the market to be successful.

We tell every single one of our clients that the truth about being successful with your investments is not about ‘timing the market’, but about the time you stay IN the market.

Myth #2: You should wait until the dust settles to invest your money.

The last few years give us a clear explanation for how the stock market generally works:

- In 2020, the year the pandemic began, the economy was terrible, BUT the stock market boomed.

- In 2022, the economy is on fire, yet the stock market is selling off.

What does this mean?

You could blame everything that happens on the government, but when we look at patterns of annualized returns at different unemployment levels in different periods in history, we can see that investing when things look bleak can lead to incredible returns. We also see that investing when things appear to be wonderful typically leads to lower returns. This is a simplification of the observation, but it makes sense that returns would be higher when the economy is in trouble because that is when prices are lower. And conversely, when the economy is doing well, prices have likely already increased.

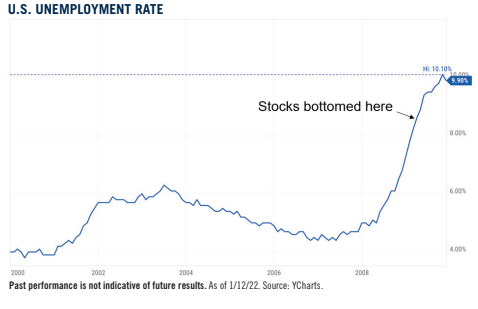

The stock market also does pretty well leading the way before the economy. In 2009, the stock market bottomed in early March. The unemployment rate continued to rise until it peaked in October, eight months later. By the time the unemployment rate peaked, stocks were already up nearly 60% from the bottom.

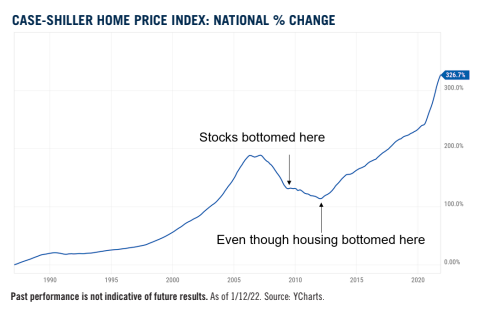

What about after the big housing crash? The stock market bottomed out 3 years before the crash. By that time, stocks were already up well over 100% by then.

In summary of this myth, if you wait for things to be perfect or for the dust to settle, you’re going to miss out because the stock market doesn’t care about good or bad, only better or worse.

Myth #3: Just wait for things to return to “normal” to invest.

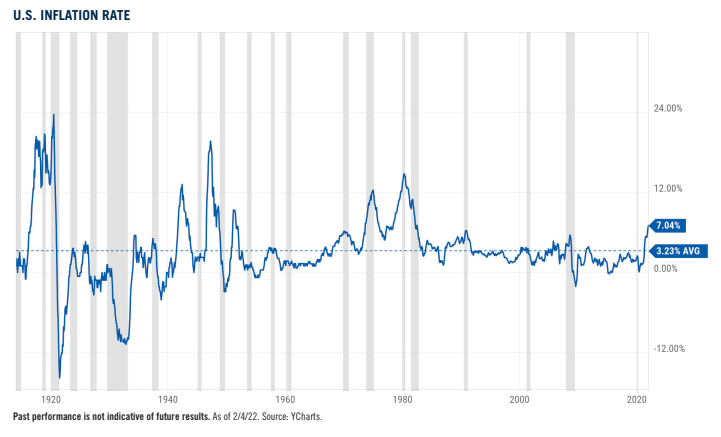

This is the U.S. inflation rate over the last 100+ years:

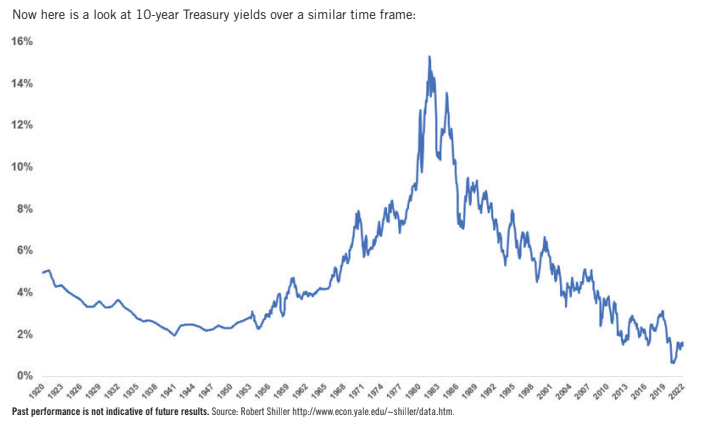

Now here is a look at 10-year Treasury yields over a similar time frame:

When were the interest rates or inflation rates “normal” on these charts spanning 100 years?

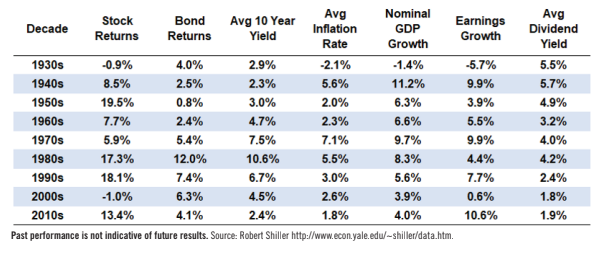

Here’s a breakdown of financial market returns, bond yields, inflation rate, economic growth, earnings growth, and dividend yields by decade going back to the 1930s:

Which one of these environments was “normal”?

There is no such thing as normal in the markets or the economy. The only constant is change.

Myth #4: A higher yield makes for a safer investment.

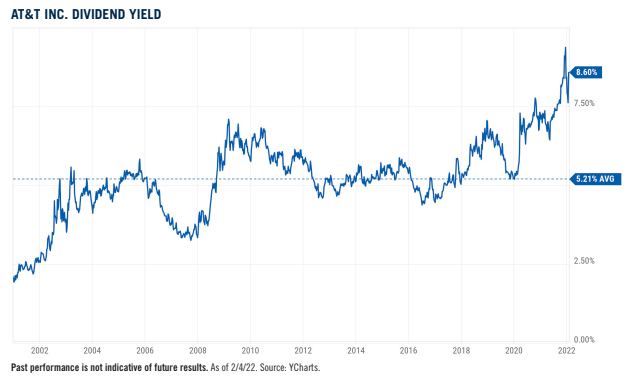

This is the average dividend yield for AT&T going back to the turn of the century:

Five percent is not bad, right?

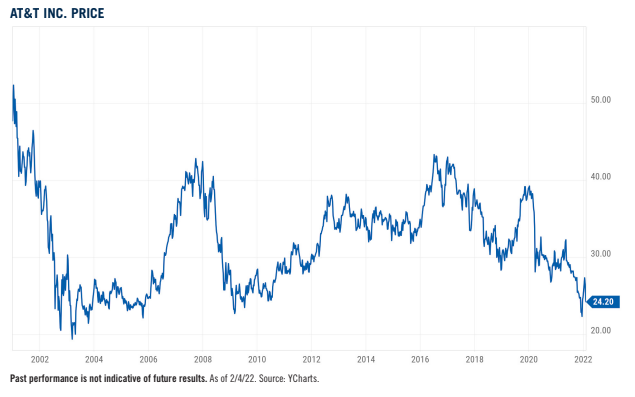

Now here’s the price chart:

The stock is more than 50% off prices from 2000 (and 40% off prices from 2017). Yes, dividend payments were still earned, but the returns were not great. In fact, there was underperformance in a simple total bond market fund, but with way more volatility.

We’re not suggesting you should avoid investing in dividend-paying stocks. A basket of dividend growth stocks can be a fantastic addition to the right portfolio. You just can’t bank on yield alone to save you when investing over the long-term. Total returns are the only ones that matter.

Investments mentioned here are listed as an example and are not a recommendation to solicit or purchase any of the securities mentioned.

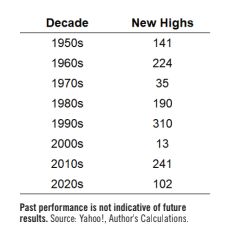

Myth #5: New highs mean the stock market is going to crash.

It can seem scary when the stock market is at “all-time highs” because eventually it will top out and switch to a bear market.

But “all-time highs” are perfectly normal. Over the last 100 years or so, one out of every 20 days the market has been open has closed at an all-time high.

Myth #6: The stock market is like a gambling at a casino.

People always compare the stock market to a casino when they lose money. However, a massive difference is that the casino has better odds than you. The longer you gamble, the greater your odds of walking away a loser (making the casino much richer).

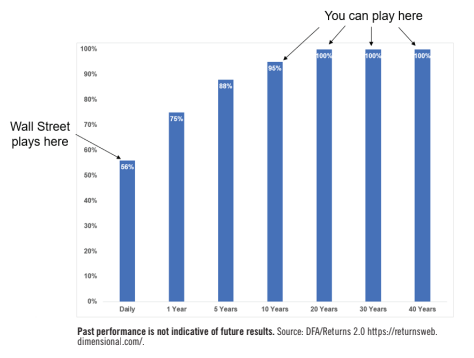

The opposite happens in the stock market, the longer you invest, the greater your odds of success. On a daily basis, it’s basically a coin flip between positive or negative returns. But, extend your time in the market and your likelihood of seeing gains has increased throughout history. The longer your time horizon in the stock market, the greater your

chances of walking away a winner. Casinos would go out of business if this were true for them.

Myth #7: Risk is quantifiable.

We can’t be over reliant upon math equations to define risk. Benchmarking and measuring is necessary and risk-adjusted returns can help investors get a better handle on what’s going on in a portfolio or individual strategy. But an over-reliance on quantitative measures (equations) can be a deterrent if you assume it is going to better predict future outcomes and success.

For individual investors these are the only two important questions to reflect upon:

- Am I on track to reach my financial goals?

- How do I minimize the probability that I won’t reach these goals?

There can never be 100% assurance on these questions, but that’s why planning is a process over time, not a one time event.

Myth #8: Complex problems require complex solutions.

Let’s say you have a $1 million portfolio. This is the annual income you would earn on this money if you put the entire amount into 10-year Treasuries over time:

1960: $47,000

1970: $78,000

1980: $108,000

1990: $82,000

2000: $67,000

2010: $37,000

Now: $19,000

Interest rates are rising but they’re still lower than they’ve been 99% of the time, historically. Because of this low rate environment, there will be plenty of investors and salespeople pushing for more complexity to make up for low yields.

But when you boil it down, there are really only two options for investors:

- Take more risk

- Lower your expectations

The financial markets are a complex, adaptive system, but you don’t need to fight complex with complex to succeed. Simple is often more effective when solving complex problems like the markets.

This article is inspired by an article written by Ben Carlson with Virtus Investment Partners.

The commentary is the opinion of the author and distributed with permission under limited license. All data and charts presented herein are from sources deemed to be reliable but are not guaranteed to be accurate. The financial information presented is for informational and educational purposes and is not a substitute for professional advice; use of or reliance on any information herein is solely at your own risk. Edited from the original.