When you’re losing money, it’s hard to stay positive and optimistic. When the markets get volatile, you might hear the suggestion to “ignore the noise.” That advice is only helpful if you’re talking to a human who doesn’t function like a human. It’s just not practical advice nor is it helpful.

A Different Perspective of Bear Markets

What IS helpful when we are experiencing volatility in the markets? Putting the short-term losses in context is one helpful strategy. It’s reframing or redefining how you talk about and think about bear markets and recessions. If you view volatility and losses as the “admission fee” for long-term returns then it doesn’t feel like a fine for making a wrong choice. Unfortunately, it is part of the process and riding it out is better than panicking and pulling out.

In our current state, it seems a little early to give you the “don’t panic” talk, given that the S&P 500® is a whopping 8.3% off its all-time high, but we’re hoping this short article can help you develop a bigger picture perspective and redefine what we’re experiencing. It is POSSIBLE that it could get worse before it gets better.

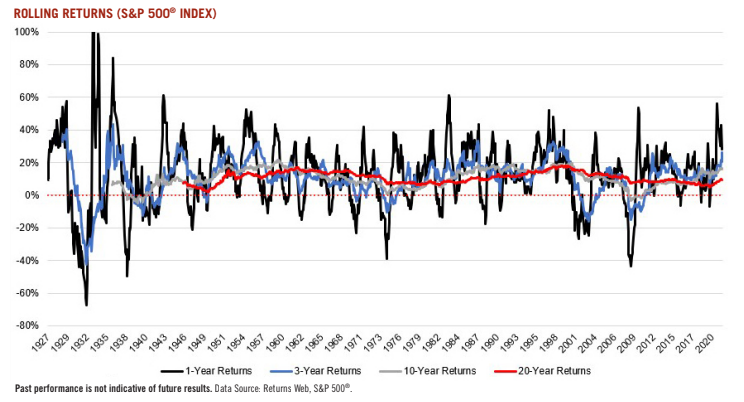

Stocks appear less volatile the less you look at them. Narrowing in on a particular time is like looking at it under the microscope. Zooming out is better than zooming in. The chart below shows rolling returns over different periods. You can see that the shifts of lifts and drops become less dramatic the less often they’re measured. In other words, zooming out you can see the trend of increasing return rather than getting tossed around by zooming in and going for a roller coaster ride.

As hard it this may seem, do your best to stay away from checking your portfolio when you’re losing money. This isn’t turning a blind eye or ignoring reality. It’s remembering to have a “zoomed out” perspective of your portfolio over time. Stocks won’t stop going down just because you’re looking at them, and the more you see your money decrease, the more likely you are to make a rash and emotional decision. An investor’s job is not to avoid the pain, but to endure it. Remember it’s the “fee for admission” as opposed to the “fine for a wrong choice.”

Riding out a Recession

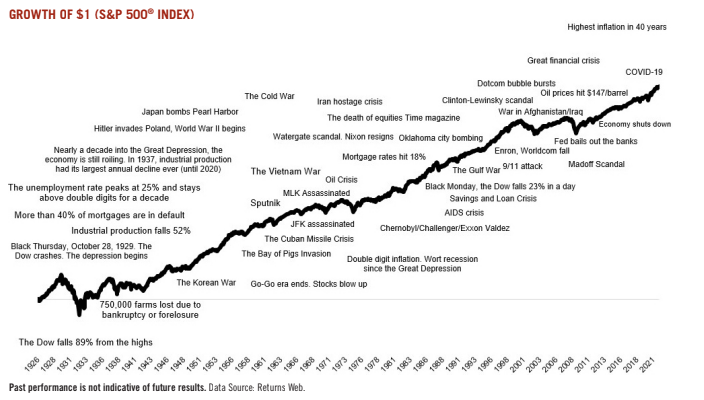

Even though bear markets can take away years of gains, they are the launching platform for decades to come—a fee, not a fine. We’re not saying you have to be all stocks all the time with no in-between. What we ARE saying is that fear cannot be your leader and panic cannot be the decision driver.

There will always be reasons to sell. Right now, we are seeing investors selling because of rising rates and high inflation. These factors are making people reconsider how much they want to pay for each dollar of earnings (they are reassessing their admission fee.) You can’t ignore the reality of the story playing out, but you can put this chapter into context. When viewed in a timeline, over time, what seemed big appears small. Do you think this episode will appear on the chart in 10 years? In one year?

The S&P 500 has compounded at 10.5% per year since 1926. To have gotten anything close to that, you had to be willing to pay the volatility “admission fee”. You pay to play.

Easier to Quote Buffet than to Act Like Him

Warren Buffett is a famous investor that people like to quote. His words and advice sound nice, but don’t necessary FEEL nice if acted upon. Buffet had a keen ability to analyze investment opportunities and stay fully committed and invested over multiple decades without giving into fear. He never sold everything and went to cash. He didn’t wait for the dust to settle, return to “normal” or try timing the market.

Not everyone reading this is a billionaire. It might feel far fetched to be able to watch your portfolio get cut in half and not panic. Truthfully, if a substantial loss like a 50% decline would impact you financially and even mentally and emotionally in such a way that is robs you of peace and joy, then it might be wise to not step into the world of the ups and downs of the market. Your investment choices should match your risk tolerance. A good advisor helps you to determine your risk tolerance up front so that you can predetermine the best paths towards your goals.

The reality is this: it isn’t fun to watch your portfolio decrease. It just isn’t. However, with a larger perspective and understanding of the pattern of the market over time, you can remain more calm and wait it out. This will position you for the rise in the future. We can’t predict if that’s tomorrow or next year, but you are faced with two choices: get out or ride it out. Choose wisely.

The commentary is the opinion of the author and distributed with permission under limited license. All data and charts presented herein are from sources deemed to be reliable but are not guaranteed to be accurate. The financial information presented is for informational and educational purposes and is not a substitute for professional advice; use of or reliance on any information herein is solely at your own risk. Edited from the original written by Michael Batnick.